Investing in Initial Public Offerings (IPOs) can be an exciting opportunity for investors looking to capitalize on the growth potential of a company at an early stage. One such IPO that has garnered significant attention in recent times is Netweb Technologies, a leading technology company specializing in innovative solutions for businesses across various industries.

Understanding Netweb Technologies

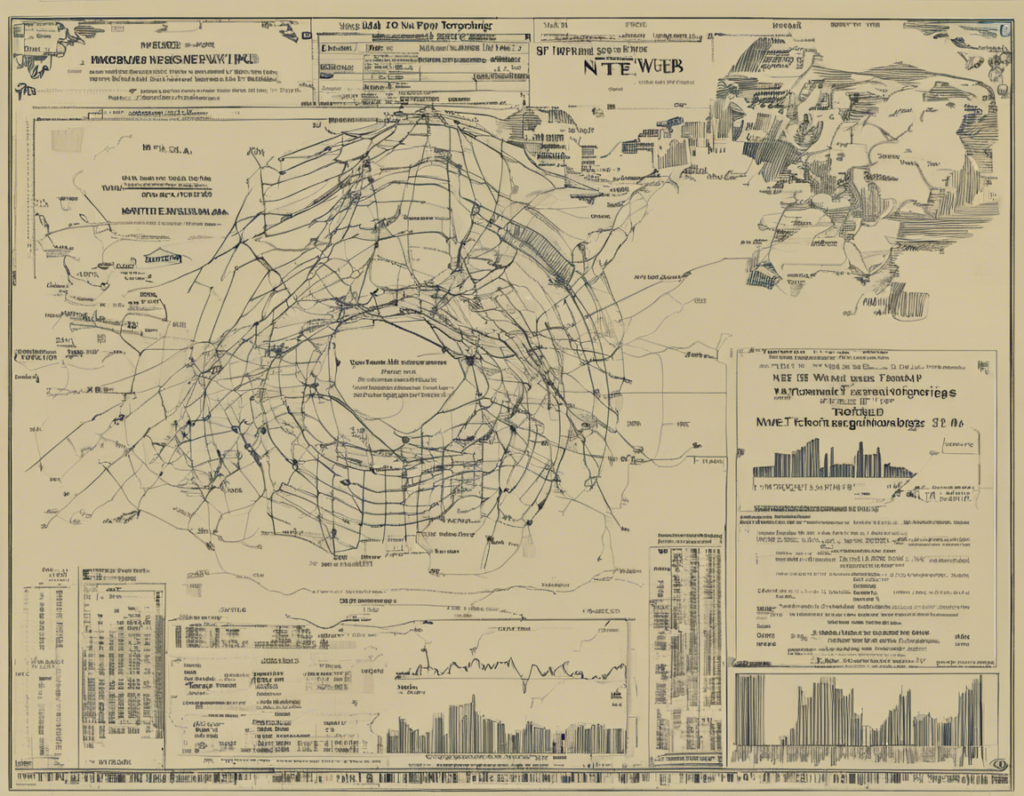

Netweb Technologies has established itself as a pioneer in the technology sector, offering a wide range of services such as software development, cloud computing, cybersecurity, and artificial intelligence. With a strong focus on delivering cutting-edge solutions to clients globally, the company has experienced rapid growth and garnered a solid reputation in the industry.

Why Invest in Netweb Technologies IPO?

1. Growth Potential

Netweb Technologies has demonstrated consistent growth over the years, driven by a robust portfolio of services and a strong client base. By investing in the company’s IPO, investors can participate in its future expansion plans and potential market dominance.

2. Innovative Solutions

The company’s focus on innovation and technology advancements sets it apart in the competitive landscape. Investing in Netweb Technologies can provide exposure to groundbreaking technologies and solutions that have the potential to disrupt traditional markets.

3. Strong Financial Performance

Netweb Technologies boasts a solid financial track record, with impressive revenue growth and profitability metrics. Investors keen on backing a financially sound company with a proven track record may find the Netweb Technologies IPO appealing.

4. Experienced Management Team

The success of any company hinges on its leadership, and Netweb Technologies is helmed by a team of industry experts with years of experience in technology and business management. A strong management team can steer the company towards long-term success, making it an attractive investment opportunity.

Considerations Before Investing

Before diving into the Netweb Technologies IPO, investors should carefully evaluate certain factors to make an informed decision:

- Market Conditions: Assess the current market environment and industry trends to gauge the potential success of the IPO.

- Competitive Landscape: Understand the competitive landscape in which Netweb Technologies operates and how it positions itself against rivals.

- Risk Analysis: Conduct a thorough risk analysis to identify potential pitfalls and challenges that could impact the company’s performance.

FAQs

Here are some frequently asked questions about the Netweb Technologies IPO:

1. What is an IPO?

An IPO, or Initial Public Offering, is the first time a company offers its shares to the public for investment. It allows the company to raise capital by selling shares and enables investors to buy ownership stakes in the company.

2. How can I participate in the Netweb Technologies IPO?

To invest in the Netweb Technologies IPO, you will need to open a trading account with a registered stockbroker and follow the application process outlined by the company and the stock exchange.

3. What are the risks associated with investing in IPOs?

Investing in IPOs carries certain risks, including market volatility, uncertainty about the company’s future performance, and potential lack of historical data to assess its viability. It is essential to conduct thorough research before investing.

4. How can I analyze the prospects of the Netweb Technologies IPO?

Investors can analyze the Netweb Technologies IPO by reviewing the company’s financial statements, growth projections, competitive positioning, and industry outlook. It is advisable to consult with financial experts for a comprehensive assessment.

5. What is the lock-up period for Netweb Technologies IPO shares?

Typically, IPO shares have a lock-up period during which early investors, employees, and company insiders are restricted from selling their shares. Investors should be aware of the lock-up period and its implications on share prices.

In conclusion, the Netweb Technologies IPO presents a compelling investment opportunity for those seeking exposure to a dynamic and innovative technology company with strong growth potential. By conducting thorough due diligence, assessing risks, and staying informed about market conditions, investors can make informed decisions about participating in this offering.